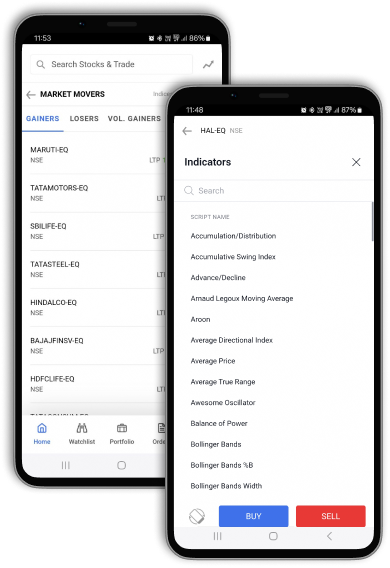

Commodities

Trading

Commodities trading present an exciting, unique and lucrative investment opportunity. TradeSmart, the online trading specialist, offers one of the best commodity trading platform in India. It is simple, effective and technology driven to create the best investor experience.