About IPO

IPO or Initial Public Offering is a process by which a private company becomes public. A company becomes 'public' when it starts selling its shares in the market for the first time. Selling shares is like selling a portion of its stake to the investors for the company. There are two types of market.

- Primary Market

- Secondary Market

IPOs are launched in the primary market.

Why does a company launch an IPO?

Companies use the IPO route to generate fresh equity capital for the company to further its business.

Who can invest in IPO?

Investors are divided into three main categories:

1. Qualified institutional buyers (QIB)

QIB portion which comprises

- Mutual funds

- Domestic Financial Institutions: Banks, Financial Institutions and Insurance Companies

- Foreign Institutional Investors

- Others

2. Non-Institutional Investors

NIIs comprise

- Corporates

- Individuals other than retail investors

- Others

3. Retail Individual Investors

What Happens after the IPO period?

Once the IPO subscription period is over, the shares are listed on the exchanges after a couple of days. After the listing, the shares are traded freely in the market during market hours.

What is the Process of Investing in an IPO Online?

1. Choose the IPO That you Want to Invest in

We generally know the latest IPO calendar of a particular year beforehand. Investing in an IPO requires research as we may not have a lot of historical data on the performance, management and other crucial fundamental factors. This is when we compare that company to a listed company. Hence, determining the IPO that you want to invest in is an essential first step. Every company that launches an IPO, shares a prospectus with the public offering details about the company’s business and future plans. Go through this prospectus thoroughly and research the company before making a decision.

2. Open the Required Accounts

You need the following three accounts to invest in a new IPO and trade them in the secondary market eventually:

Premium Account : This is where you store your shares in an electronic form.

Bank Account: A bank account is required to fund your share market transactions. However, a bank account can come in handy to apply for an IPO as well. Almost all net-banking platforms have the facility to apply for IPOs through the Application Supported by Blocked Amount (ASBA) facility.

Trading Account: Trading account is used to buy and sell shares. You can open a trading account with Tradesmartw.

3: What happens after you apply for an IPO?

The process is a little different. When you apply for a company's IPO, regardless of any method of application, the aggregate amount gets blocked from your bank account. It will show up in your balance but will not be available for use. Once the allotment is finalised, if you have received the shares the amount will get debited from your account. If you have not received any shares in the IPO, the amount will be unblocked and will be available for use.

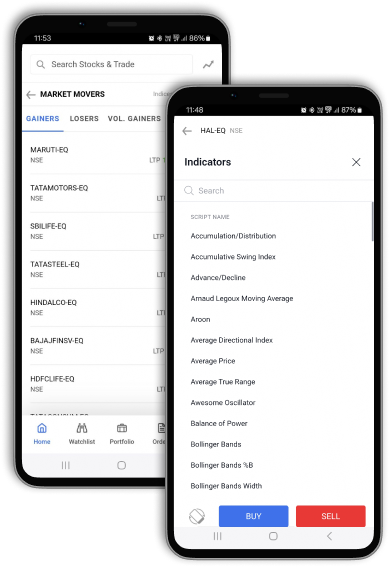

How to apply for IPO on TradeSmart?

Once you have done the preliminary process of registering on the Tradesmartw app, opening a demat-cum-trading account and KYC verification, applying for IPO is an easy process

Open your Tradesmartw App, scroll down on the stocks tab and click on the IPO section.

The next page will show a list of live IPOs, upcoming IPOs and IPOs that are already closed by now

Pick the live IPO you want to invest in

In the next page, mention the number of lots you want to apply for

- Here you will be asked for your UPI ID. After you complete the process on the UPI app, the money will get blocked from your account

- The status of your IPO application will show up next to your application number in the same section

EbixCash Ltd.

EbixCash Ltd.

Indiafirst Life Insurance Company Ltd.

Indiafirst Life Insurance Company Ltd.

Ather Energy Ltd.

Ather Energy Ltd.

Inspros Engineers Ltd.

Inspros Engineers Ltd.

Ganesh Consumer Products Ltd.

Ganesh Consumer Products Ltd.

SeedWorks International Ltd.

SeedWorks International Ltd.

Healthy Life Agritec Ltd.

Healthy Life Agritec Ltd.

Patel Retail Ltd.

Patel Retail Ltd.

Mouri Tech Ltd.

Mouri Tech Ltd.

Star Agriwarehousing And Collateral Management Ltd.

Star Agriwarehousing And Collateral Management Ltd.

Vidya Wires Ltd.

Vidya Wires Ltd.

Hexagon Nutrition Ltd.

Hexagon Nutrition Ltd.

WAPCOS Ltd

WAPCOS Ltd

Metalman Auto Ltd.

Metalman Auto Ltd.

Aditya Infotech Ltd.

Aditya Infotech Ltd.

Laxmi India Finance Ltd.

Laxmi India Finance Ltd.

Karamtara Engineering Ltd.

Karamtara Engineering Ltd.

Navi Technologies Ltd.

Navi Technologies Ltd.

Viaz Tyres Ltd.

Viaz Tyres Ltd.

Regreen-Excel EPC India Ltd.

Regreen-Excel EPC India Ltd.

Brigade Hotel Ventures Ltd.

Brigade Hotel Ventures Ltd.

Gem Aromatics Ltd.

Gem Aromatics Ltd.

Innovatiview India Ltd.

Innovatiview India Ltd.

Puranik Builders Ltd.

Puranik Builders Ltd.

B-Right Real Estate Ltd.

B-Right Real Estate Ltd.

Property Share Investment Trust REIT

Property Share Investment Trust REIT

Plaza Wires Ltd.

Plaza Wires Ltd.

Sah Polymers Ltd.

Sah Polymers Ltd.

Radiant Cash Management Services Ltd.

Radiant Cash Management Services Ltd.

Elin Electronics Ltd.

Elin Electronics Ltd.

Quality Power Electrical Equipments Ltd.

Quality Power Electrical Equipments Ltd.

Hexaware Technologies Ltd.

Hexaware Technologies Ltd.

Ajax Engineering Ltd.

Ajax Engineering Ltd.

Dr. Agarwal's Health Care Ltd.

Dr. Agarwal's Health Care Ltd.

Denta Water And Infra Solutions Ltd.

Denta Water And Infra Solutions Ltd.

Stallion India Fluorochemicals Ltd.

Stallion India Fluorochemicals Ltd.

Laxmi Dental Ltd.

Laxmi Dental Ltd.

Capital Infra Trust

Capital Infra Trust

Quadrant Future Tek Ltd.

Quadrant Future Tek Ltd.

Standard Glass Lining Technology Ltd.

Standard Glass Lining Technology Ltd.

Indo Farm Equipments Ltd.

Indo Farm Equipments Ltd.

Unimech Aerospace and Manufacturing Ltd.

Unimech Aerospace and Manufacturing Ltd.

Senores Pharmaceuticals Ltd.

Senores Pharmaceuticals Ltd.

Carraro India Ltd.

Carraro India Ltd.

Ventive Hospitality Ltd.

Ventive Hospitality Ltd.

Mamata Machinery Ltd.

Mamata Machinery Ltd.

Sanathan Textiles Ltd.

Sanathan Textiles Ltd.

Concord Enviro Systems Ltd.

Concord Enviro Systems Ltd.

DAM Capital Advisors Ltd.

DAM Capital Advisors Ltd.

Transrail Lighting Ltd.

Transrail Lighting Ltd.

International Gemmological Institute (India) Ltd.

International Gemmological Institute (India) Ltd.

Inventurus Knowledge Solutions Ltd.

Inventurus Knowledge Solutions Ltd.

Sai Life Sciences Ltd.

Sai Life Sciences Ltd.

Vishal Mega Mart Ltd.

Vishal Mega Mart Ltd.

One Mobikwik Systems Ltd.

One Mobikwik Systems Ltd.