Aside from the purchase price of securities, trading in them requires paying certain fees. The brokerage fee, which a trader must pay to the concerned broker, is one of the most essential and prevalent of these costs. This brokerage is a kind of fee that is paid to a broker for facilitating trading.

Brokerage is often levied as a percentage of the whole trade value. Brokers charge this fee in addition to the initial trade value and subtract it from the trader's portfolio. Depending on the size of the deal, such a monetary outlay may be significant. As a result, many investors utilise a brokerage calculator to get an idea about brokerage charges.

What is a currency brokerage calculator?

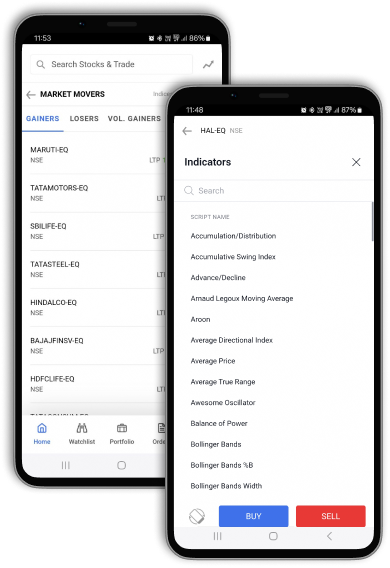

Currency brokerage calculator is an online tool that brokers and other investing platforms make available to traders to ease brokerage computation before executing a trade. A currency brokerage calculator, on the other hand, does more than just calculate brokerage. It also computes stamp duty, transaction fees, the SEBI turnover fee, GST, and the Securities Transaction Tax (STT).

Below are the requirements for input into the brokerage calculator

An online currency brokerage calculator considerably simplifies the process of determining the cost of a transaction. To calculate their trading costs, an individual needs to enter the following information into our currency brokerage calculator:

- Segment - (Select the segment that you are going to trade. If you are trading in the futures segment, select futures. If you are trading in the options segment, select options)

- Quantity (Enter the number of lots you are buying or selling)

- Buy price - (Enter buying price)

- Sell price - (Enter selling price)

- Exchange - (Enter the stock exchange name)

- Number of orders

As soon as you enter the above details, the commodity calculator shows the below data:

- Brokerage

- Other charges

- Breakeven

- Net P/L

There is an option to view these charges as a breakup. If you select it, the below data is displayed.

- Turnover

- Brokerage

- Turnover charges

- STT total

- GST

- SEBI charges

- Stamp duty

- Total charges

- Net buy value

- Net sell value

- Points to breakeven

Advantages of our currency brokerage calculator

1. Informed decisions

This tool informs traders or investors about brokerage fees before they make a trade. As a result, it enables them to make more educated trading judgments.

2. Compare brokerage partners

Brokerage calculators are quite useful when deciding between brokering partners. They give the necessary information for comparing the expenditure structure, price plans, and charges of brokers.

3. Additional charges

Currency brokerage calculator in addition to brokerage fees also provides various charges such as Securities Transaction Tax, Goods and Service Tax, state-by-state stamp duty, SEBI charges, turnover charges, and so on.

4. Breakeven

Brokerage calculations also show how many points a transaction needs to break even.