Equity Trading

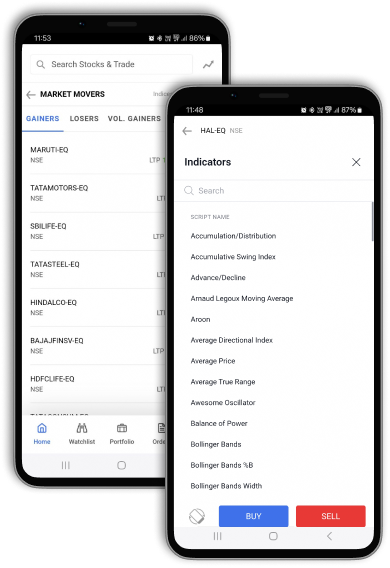

Equity Trading is a great wealth creation tool. The ease of entry/exit, favorable tax guidelines and the potential to generate superior returns, makes it a crowd favourite. TradeSmart offers one of the best online equity trading platforms in India.

Equities are shares or stocks offered by a company, in return for money. These shares come with a host of privileges such as ownership (proportionate to the invested amount), voting rights, etc. depending on the type of stocks. An equity market is the place where trading in equity or shares takes place.