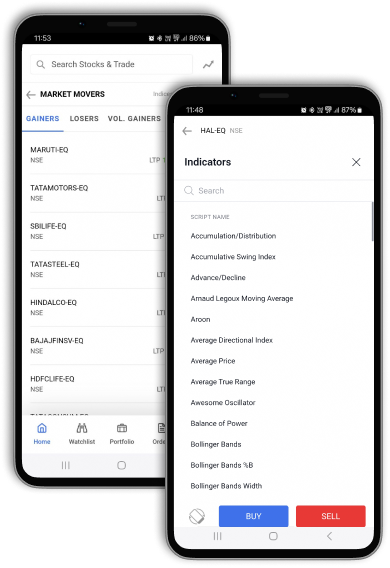

MCX Trading

Commodity trading is on a major rise in the country. MCX managed to grab 94% of the market share in FY19-20, thanks to the exponential swell in energy and bullion turnover. Become a beneficiary in this growth with the help of TradeSmart. Our superior technical analysis coupled with technological edge will help you trade faster, with lower brokerage and better margins.