Understanding the Role of Depositories, Depository Participants and DP Names in an IPO

Feb 16 2022 4 Min Read

Examining the IPO Landscape Today

The past few years have witnessed several initial public offerings crop up. More investors and traders alike are beginning to gravitate towards the primary market. Since IPOs are easy to sign up for and invest in, their popularity has surged. In the past, those hoping to invest in IPOs had to fill out and submit physical forms. Today, however, IPO applications can be made online with ease. While the medium has changed, the technical terms that govern IPOs remain the same. Some of these, such as DP can confuse individuals. In order to understand what DP names are, you must first comprehend the role of depositories and depository participants.

What are Depositories?

In order to function, stock markets require investors who each possess the following accounts.

- A Premium Account – This account is run by the depository

- A trading account – This account is operated by a broker or by the depository participant directly

- A bank account – This account is held and operated by the bank.

Investors must transfer money from their bank accounts to their trading accounts in order to purchase shares. Such transactions are conducted via the exchanges and in lieu of the money invested, specific securities are added to the investor’s Premium Account .

How Do These Securities Exist?

Now, you might be wondering the manner in which these credited securities exist within an investor’s Premium Account . They exist in a dematerialized i.e., electronic form and aren’t handed over in any physical form. These securities lie within an investor’s Premium Account which is under the control of a depository.

Defining a Depository – A depository is responsible for storing securities that switch hands-on stock exchanges.

Depositories in India – India is home to the following depositories.

- National Securities Depository Limited (or NSDL) – This was the country’s first depository and was promoted by the National Stock Exchange in addition to the IDBI and UTI.

- Central Depository Services (India) Limited (or CDSL) – The Bombay Stock Exchange promoted this depository and was followed by major banks like HDFC Bank and the State Bank of India doing the same.

Advantages Associated with Depositories

The following advantages are associated with the usage of a depository system.

- Dematerialization – Prior to shares being held in a dematerialized form, it wasn’t easy to participate in share markets. The depository system enabled securities to exist in this electronic form which allowed for a paper-free share market. Not only is this market easier to operate, but it also allows for safer trades to occur.

- Ease of Exchange – Dematerialization views securities of the same class as identical thereby enhancing their interchangeability. The cost of exchanges has reduced and the speed with which trades are conducted has been accelerated with the aid of depositories being in existence.

- Free Transferability – Transferring securities between depositories is free and is carried out via a secure electronic system. Since this system is employed, share transfers occur instantly, however it does take T+2 days for the final settlement to appear.

Taking a Look at Depository Participants

Depositories can be understood as the vaults that hold securities. However, they must not be confused to be directly engaging with investors or the companies that issue said securities.

Who are Depository Participants?

- SEBI-registered entities are depository participants that serve as the interface between investors and the depositories.

- They can be any institution such as a banking institution or a brokerage.

What Then, is a DP Name?

Now that you know the differences that exist between a depository and a depository participant, you should not be confused in case you see a question asking about the DP name at the time of filling out an IPO application.

A DP name is simply the depository participant’s name. In this case, TradeSmart will be the name of the DP that is registered with the CDSL. Therefore, the DP name box is filled out with the name of the broker. Ordinarily, the DP name follows the Depository, DP ID, and DP account. Premium Account numbers issued by the NSDL and the CDSL are fairly easy to identify. Those issued by the NSDL begin with ‘IN’ while those issued by CDSL begin with a numeric digit. Under the depository section, you must choose whether your depository is NSDL or CDSL.

What is a DP ID?

- A DP ID refers to the number allocated to a depository participant by their depository. This DP ID number varies from the 16-digit Premium Account number assigned to those seeking to participate in the markets.

- Ordinarily, the first eight digits of an individual’s Premium Account number constitute their DP ID.

Applying for an IPO with TradeSmart

Now that you’ve understood the meaning of a DP name and DP id, the process of applying for an IPO is pretty straightforward. An account with a broker is a prerequisite for investing in an IPO. The investment can be done by following the below mentioned steps:

- Do your preliminary research and assess whether the IPO is worth investing in. Log in to your TradeSmart broker account with your email address and mobile phone number.

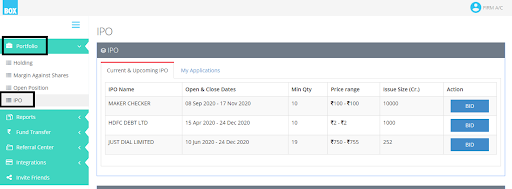

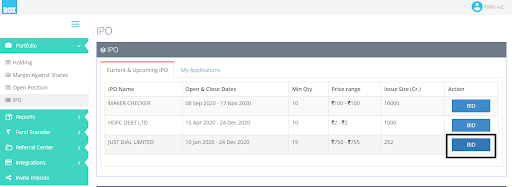

- Login to BOX and under the portfolio menu, select the ‘IPO’ option

- From the list of Current & Upcoming IPO’s, click on BID to participate in the IPO offer

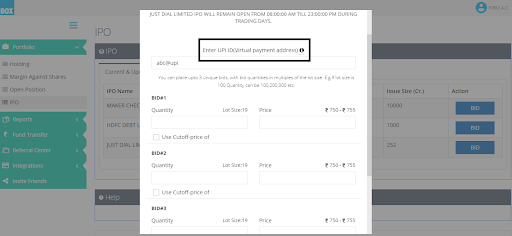

- Enter your UPI ID.

- Please make sure the UPI ID is mapped to your personal bank account.

- The IPO application is liable to get rejected if the person who is applying is different from the one whose bank account is used to apply. Third person bank accounts are not accepted.

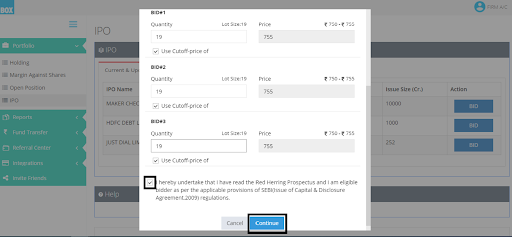

- Place your bid(s). Please note the below points.

- While placing the bids, only quantity that is a multiple of the lot size is allowed.

- If you wish to apply at the cut-off price, simply click on the checkbox next to ‘Cutoff-price’. If you want to place a bid at a different price, you can do so by entering a price in the ‘Price’ field.

- Once you’ve completed all these steps, click on the checkbox to confirm that you have read the RHP and other documents.

- Click on Continue

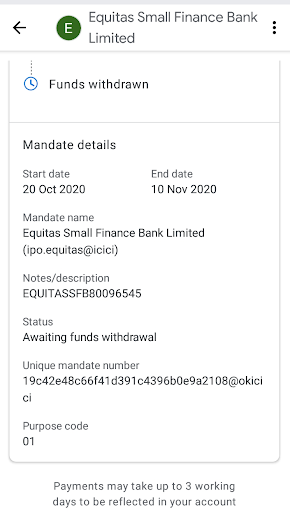

- Accept mandate request on your UPI App:

- At the end of the day after submitting the IPO bid, you will receive an SMS from the exchange confirming your application. You may also check the status of your bid in My Applications tab.

Wrapping Up

Applying for an IPO has never been easier as the process has been simplified greatly. As there are several details that are still required to be filled out while applying for an IPO, it is easy to get confused. This article, however, should have provided you with sufficient clarity such that you can apply for an IPO with ease.

Frequently Asked Questions

The two different depositories present in India include the following.

- National Securities Depository Limited (or NSDL)

- Central Depository Services (India) Limited (or CDS

Three benefits associated with the usage of a depository system are as follows.

- Dematerialization

- Ease of Exchange

- Free Transferability

SEBI-registered entities are depository participants that serve as the interface between investors and depositories. They can be any institution such as a banking institution or a brokerage.

A depository is responsible for storing securities that switch hands-on stock exchanges.